Wall Street has been paying close attention to Wave Life Sciences Ltd. recently, with the business experiencing a large increase in short interest over the month of March. Founded in 2012 by Gregory L. Verdine and Takeshi Wada, the biotech company focuses on nucleic acid-based therapies and incorporates its own patented drug development technology.

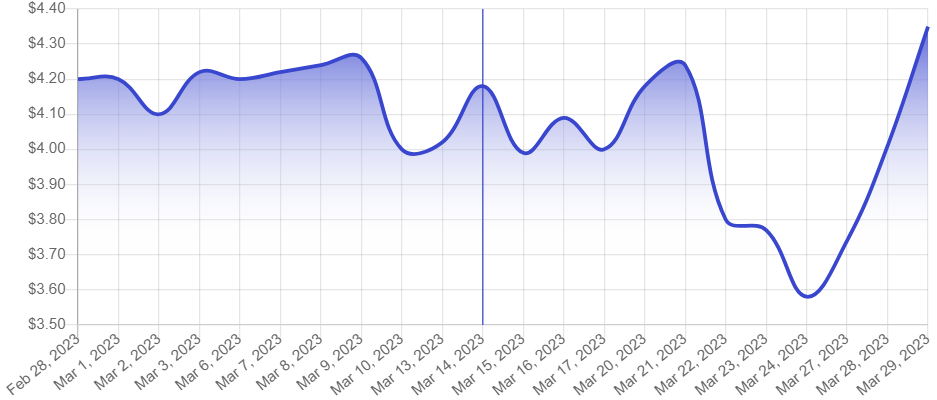

On the 15th of March, short interest had increased by about 36.6%, from 1,120,000 shares in February to 1,530,000 shares. The current average daily trading volume is 470,300 shares, and the short-interest ratio is at 3.3 days.

On Wednesday, Wave Life Science Ltd. shares began at $4.01, with a one-year low of $1.16 and a one-year high of $7.12. Its market capitalization is valued at $393.40 million, while its PE ratio is -1.88 and its beta is -0.86.

Several equity research analysts have recently given reports on Wave Life Sciences Ltd, including HC Wainwright, which reiterated its “buy” rating and set a price target of $8 for the stock in a report issued on March 23.

In December of last year, SVB Leerink also issued the biotechnology company a “market perform” rating while increasing their price target from $2 to $7. On March 16th of this year, StockNews.com assigned a “hold” rating to its coverage of Wave Life Sciences Ltd.

Wall Street has been buzzing for months about Wave Life Sciences, which is undoubtedly poised for further development and commercialization of nucleic acid-based therapeutics; we recommend keeping a close eye on how recent events play out, as they may have an impact on investment opportunities in the biotech company.

Wave Life Sciences Ltd.: A Biotech Firm on the Rise Due to Insider Sales and Institutional Investing

Wave Life Sciences Ltd. is a fast expanding biotechnology business specializing in the development of pharmaceuticals based on synthetic chemistry. Using cutting-edge technology, the business focuses on creating, manufacturing, and marketing nucleic acid-based therapies to address genetic illnesses. Gregory L. Verdine and Takeshi Wada founded the company on the 23rd of July, 2012, in Singapore. Over a short period of time, it has achieved amazing success.

On February 16th, CEO Paul Bolno sold 29,400 shares at an average price of $4.04 per share, according to recent reports. Before he was left with 407,425 direct shares of the firm worth a stunning $1,645,997, the entire amount of the transaction was reported as $118,776.00. Likewise, CFO Kyle Moran sold 9,729 shares at an average price of $4.04 per share for a total value of $39,305.16 and currently has 79,751 Wave Life Science shares valued at around $322k.

The sales were properly reported to the Securities and Exchange Commission (SEC), adding to previous disclosures that make available information about insider selling behavior regarding company stock ownership patterns and trends in transactional data analysis performed over the last ninety days indicating that insiders have sold 49,378 Wave Life Sciences shares worth $199k despite owning more than thirty-two percent (32.20%) of the company’s stock.

Due to Wave Life Science Ltd’s current business portfolio growth rate, hedge funds have recently modified their holdings and invested capital in the company. Dorsey Wright & Associates, for instance, recently acquired a new stake in the company for approximately $31k, while Tower Research Capital LLC TRC increased its stake percentage by more than 256%.

A shift in focus towards Mirabella Financial Services LLP during the first quarter of this year suggests that they paid roughly $44,000 to purchase a new investment in Wave Life Science, with Cubist Systematic Strategies LLC contributing approximately $67,000 for the same purpose. Seventy-seven percent (77.18%) of the company’s stock is now owned by institutional investors and hedge funds, which is a significant indication of investor confidence on a global scale.

Since its founding in 2012, Wave Life Sciences Ltd. has demonstrated its potential to excel in the biotech business through its creative approach to producing personalised treatments. The recent deals executed by CEO Paul Bolno and CFO Kyle Moran, as well as the increased interest demonstrated by hedge funds, indicate promising growth possibilities within a market share that is continually expanding.